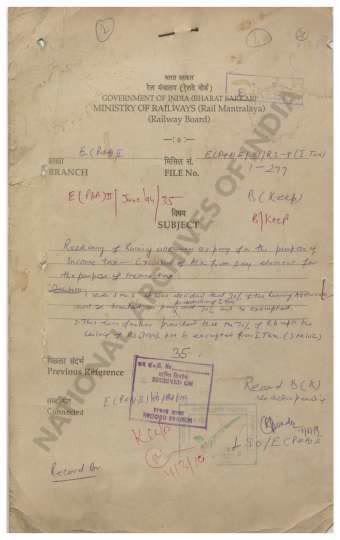

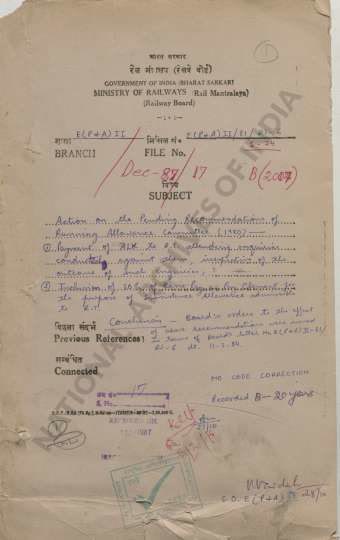

Reckoning of Running Allowance as pay for the purpose of Income Tax-Exclusion of ALK from pay element for the purpose of I/Tax. Decision- 1. Vide S.No. 6 it were decided that 30% of the Running Allowance with be treated as pay for deducting Income Tax and 70% will be exempted. 2. This were further provided that the 70% of RA upto the ceiling of Rs. 3000/- pm is exempted from I Tax.(S. No. 102)

| Keywords | Shri R.P. Yadav Income-Tax Act India Guards Council |

| Ministry/ Department/ Residency | Ministry of Railway |

| Branch | Establishment Pay and Allowance II |

| From Year / Date (YYYY-MM-DD) |

1981 |

| To Year / Date (YYYY-MM-DD) |

1981 |

| Source Organization | NA |

| Identifier | PR_211200048249 |

| File No./Reference No./Sheet No./Folio No. | E/P and A/II/81-RS-9/I-TAX/1-277 |

| Location | Repository-4 |

| Part No. | NA |

| File Size | 249.2 MB |

| Pages | 514 |

| Collection | Digitized Public Records Ministry of Railway |

| Call Number | NA |

| Publisher | NA |

| Subject | NA |

| Creator | NA |

| Accession Number | NA |

| Series | NA |

| Year of Publication | NA |

| Language | English, Hindi |

| Bundle Barcode | NA |

| Location Code | NA |

| File Barcode | NA |

-

16 views