Assessment of Property Tax (House Tax) on Railway Buildings at Nagpur. Instructions that if the tax on non-residential buildings is considered inequitable by the Railway, the only course open to the Railway is to take action under section 3(2) of the Railways (Local Authorities Taxation) Act, 1941, and that the tax on residential buildings could be paid on ex-gratia basis

| Keywords | Nagpur Corporation Act Municipal Committee |

| Ministry/ Department/ Residency | Ministry of Railway |

| Branch | Finance Expenditure II |

| From Year / Date (YYYY-MM-DD) |

1950 |

| To Year / Date (YYYY-MM-DD) |

1950 |

| Source Organization | NA |

| Identifier | PR_211200040282 |

| File No./Reference No./Sheet No./Folio No. | F/X/II/50/TX-12/13/1-14 |

| Location | Repository-4 |

| Part No. | NA |

| File Size | 15.5 MB |

| Pages | 40 |

| Collection | Digitized Public Records Ministry of Railway |

| Call Number | NA |

| Publisher | NA |

| Subject | NA |

| Creator | NA |

| Accession Number | NA |

| Series | NA |

| Year of Publication | NA |

| Language | English |

| Bundle Barcode | NA |

| Location Code | NA |

| File Barcode | NA |

-

8 views

Other Similar Items

-

- 13 Views

- Assessment of Property Tax (House Tax) on Railway ...

- Department: Ministry of Railway

- Branch: Finance Expenditure II

- Year / Date: 1950

-

- 10 Views

- Assessment of Property Tax (House Tax) on Railway ...

- Department: Ministry of Railway

- Branch: Finance Expenditure II

- Year / Date: 1950

-

- 6 Views

- Assessment of Property Tax (House Tax) on Railway ...

- Department: Ministry of Railway

- Branch: Finance Expenditure II

- Year / Date: 1950

-

- 13 Views

- Assessment of Nagpur's Railway Buildings' Property...

- Department: Ministry of Railway

- Branch: Finance Expenditure II

- Year / Date: 1950

-

- 13 Views

- Assessment of Nagpur's Railway Buildings' Property...

- Department: Ministry of Railway

- Branch: Finance Expenditure II

- Year / Date: 1950

-

- 7 Views

- Taxation of the Central Railway properties situate...

- Department: Ministry of Railway

- Branch: Finance Expenditure II

- Year / Date: 1953

-

- 8 Views

- Taxation of the Central Railway properties situate...

- Department: Ministry of Railway

- Branch: Finance Expenditure II

- Year / Date: 1953

-

- 1 View

- Instructions that if the tax on non-residential bu...

- Department: Railways

- Branch: Finance

- Year / Date: 1952

-

- 12 Views

- In the New Delhi Municipal Area, there is a house ...

- Department: Ministry of Railway

- Branch: Finance Expenditure II

- Year / Date: 1947

-

- 9 Views

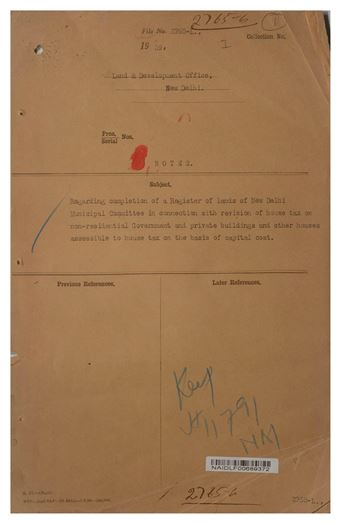

- Regarding completion of a Register of lands of New...

- Department: Land and Development Office

- Branch: Lease

- Year / Date: 1939