Ruling that when an estates is held by an executor under a will, super tax should be levied only on the undistributed income of the estate in the hands of the executor, while in assessing beneficiaries the amounts received by them from the executor should be taken into account in determining the taxable income and the rate at which their whole income is to be assessed to super tax.

| Ministry/ Department/ Residency | Finance Department |

| Branch | Separate Revenue |

| From Year / Date (YYYY-MM-DD) |

1920-06 |

| To Year / Date (YYYY-MM-DD) |

1920-06 |

| Source Organization | NA |

| Identifier | PR_000001471455 |

| File No./Reference No./Sheet No./Folio No. | Progs., Nos.102, June 1920. |

| Location | NA |

| Part No. | PART A |

| File Size | NA |

| Pages | NA |

| Call Number | NA |

| Publisher | NA |

| Subject | NA |

| Creator | NA |

| Accession Number | NA |

| Series | NA |

| Year of Publication | NA |

| Bundle Barcode | NA |

| Location Code | NA |

| File Barcode | NA |

-

17 views

The National Archives of India is on a mission to digitize and make available online each and every record in its repositories. This is an ongoing effort and some records will be made available before the others.

Hereby you can give us your request for a particular record and we shall digitize and make it available on priority, at a fee, subject to its availability in legitimate conditions.

Other Similar Items

-

- 14 Views

- Ruling that when an estate is held by an executor ...

- Department: Legislative

- Branch: Unofficial

- Year / Date: 1920

-

- 29 Views

- Ruling that in determining the assessment to super...

- Department: Finance Department

- Branch: Separate Revenue

- Year / Date: 1917-08

-

- 3 Views

- Assessment – Wakif property – shares of only some ...

- Department: Central Board of Revenue

- Branch: Income Tax,Part-IV

- Year / Date: 1941

-

- 41 Views

- Method of assessing to income -tax the profits of ...

- Department: Central Board Of Revenue

- Branch: Inland Revenue

- Year / Date: 1923

-

- 20 Views

- --proceedings the assessees income was below the t...

- Department: Central Board Of Revenue

- Branch: Income Tax

- Year / Date: 1923

-

- 4 Views

- Assessment – wall appointing certain person as exe...

- Department: Central Board of Revenue

- Branch: Income Tax,Part-IV

- Year / Date: 1940

-

- 13 Views

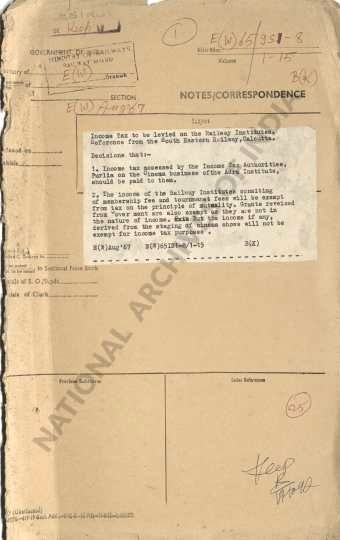

- Income Tax to be levied on the Railway Institutes....

- Department: Ministry of Railway

- Branch: Establishment Welfare

- Year / Date: 1965

-

- 9 Views

- Income Tax to be levied on the Railway Institutes....

- Department: Ministry of Railway

- Branch: Establishment Welfare

- Year / Date: 1965

-

- 13 Views

- Ruling that in the case of a person retiring with ...

- Department: Finance Department

- Branch: Separate Revenue

- Year / Date: 1887-10

-

- 10 Views

- Decision that Income Tax should not be levied on s...

- Department: Finance Department

- Branch: Separate Revenue

- Year / Date: 1918-05